Cash flow is the lifeblood of any business, and mismanaging it can lead to serious financial trouble. In this post, we’ll explore the importance of cash flow and the risks of mismanaging it, and provide some practical tips for keeping your business’s cash flow healthy.

Why cash flow is important

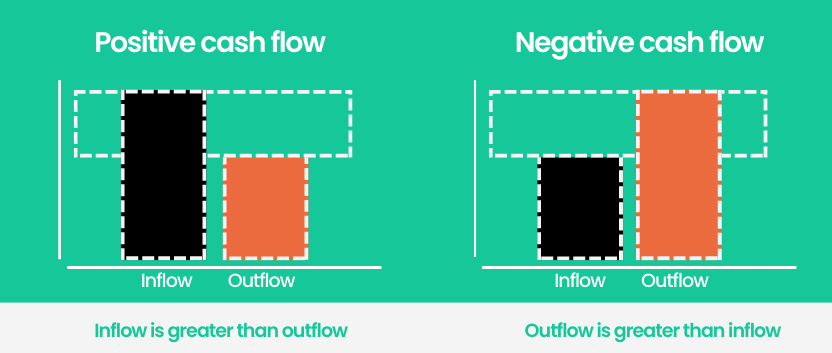

Cash flow is the amount of money coming in and going out of your business. It’s important because it determines whether or not your business has enough money to pay its bills, invest in new opportunities, and maintain a healthy bottom line.

In simple terms, businesses need cash to survive. Without enough cash on hand, businesses may struggle to pay bills and make payroll, which can lead to financial distress and even bankruptcy. This is why managing cash flow is so critical for the health and survival of a business.

The risks of mismanaging cash flow

Mismanaging cash flow can have serious consequences for your business. Some of the risks include:

- Running out of cash: If you don’t have enough cash on hand to pay your bills, you’ll quickly find yourself in financial trouble.

- Difficulty obtaining financing: Lenders and investors will be less likely to provide funding if they see that your business is struggling with cash flow.

- Limited ability to invest in growth: Without enough cash on hand, you may miss out on opportunities to invest in new products, services, or technologies that could help your business grow.

- Difficulty retaining employees: If you can’t make payroll, you’ll have a hard time keeping your employees happy and motivated.

- Difficulty meeting obligations: If you can’t pay your bills on time, you’ll quickly develop a reputation as a business that can’t be trusted to pay its obligations.

Tips for managing cash flow

Managing cash flow can be challenging, but there are a few key things you can do to improve your cash flow and reduce the risks of mismanaging it.

- Keep a close eye on your cash flow: You can’t manage what you don’t measure, so it’s important to track your cash flow regularly. This will help you identify potential problems early on, so you can take action to address them.

- Control your expenses: One of the best ways to improve your cash flow is to keep a close eye on your expenses. Look for ways to reduce costs and eliminate unnecessary spending.

- Improve your billing and collections processes: Make sure you’re billing your customers promptly and following up on any overdue invoices. This will help you get paid faster and improve your cash flow.

- Negotiate better terms with suppliers: Make sure you’re getting the best possible terms from your suppliers. This can include longer payment terms, discounts for early payment, or other incentives.

- Seek advice from experts: If you’re struggling with cash flow, don’t be afraid to seek help from a financial expert. They can help you identify the root cause of your cash flow problems and develop a plan to address them.

Examples of good and bad cash flow management

Case study 1: Effective cash flow management for a manufacturing business

ABC Manufacturing is a small business that specialises in producing custom-made machinery. The company had been struggling with cash flow for a while, but they implemented several changes that helped them turn things around.

ABC Manufacturing started by reviewing their expenses and cutting costs wherever they could. They renegotiated contracts with suppliers to get better terms, and they eliminated unnecessary expenses such as office snacks and monthly subscriptions.

They also implemented a more effective billing and collections process. They started invoicing customers as soon as a job was completed, and they followed up promptly on any overdue invoices. This helped them get paid faster, which improved their cash flow.

They also started offering financing options to customers. This helped them get paid faster, and it also helped them attract new customers who were looking for financing options.

Additionally, ABC Manufacturing started regularly reviewing their cash flow and budgeting for future expenses. This helped them identify potential problems early on, so they could take action to address them.

By taking these steps, ABC Manufacturing was able to improve their cash flow and put themselves on a more solid financial footing. As a result, they were able to invest in new equipment, expand their product line and hire more employees.

Case study 2: Negative cash flow management for a professional services business

Horizon Consulting provides financial advice to small businesses. The company had been growing rapidly, but they had not been paying attention to their cash flow. As a result, they started to experience cash flow problems.

Horizon Consulting had not been keeping a close eye on their expenses. They had been spending money on unnecessary things such as expensive office space, high-end office equipment, and luxury business trips.

They also had poor billing and collections processes. They were invoicing customers slowly and not following up on overdue invoices. This resulted in slow payment and led to cash flow problems.

Additionally, they had not been budgeting for future expenses. As a result, they were caught off guard when unexpected expenses came up, and they didn’t have enough cash on hand to cover them.

They also had not been seeking help from experts. They had not been reviewing their financial statements regularly and did not have a clear understanding of their cash flow. This made it difficult for them to identify the root cause of their cash flow problems.

If Horizon Consulting had taken steps to better manage their cash flow, they could have avoided these problems. For example, they could have:

- Reviewed their expenses regularly and eliminated unnecessary spending

- Implemented a more effective billing and collections process

- Budgeted for future expenses

- Sought help from financial experts

- By taking these steps, they could have improved their cash flow and avoided the financial distress that they ultimately faced.

These are fictional examples, clearly, but they are based on real-world scenarios that businesses face. It’s crucial for any business to keep a close eye on their cash flow, and take steps to improve it as needed. When cash flow is managed well, a business can invest in growth, increase efficiency, maintain a healthy bottom line and ultimately achieve its goals.

The takeaway

Cash flow is the lifeblood of any business, and mismanaging it can lead to serious financial trouble. By keeping a close eye on your cash flow, controlling your expenses, improving your billing and collections processes, negotiating better terms with suppliers, and seeking help from experts, you can improve your cash flow and reduce the risks of mismanaging it.

If you need help with your business finances and working capital solutions, we can assist you. At Fifo Capital, we specialise in helping SME and corporate businesses to improve their cash flow and their overall business. We can help you develop a customised solution that will help you achieve your financial goals and keep your business running smoothly.

Once you understand how to use working capital effectively, you can access a whole new level of potential benefits, discounts and security for your business and your supply chain. Get in touch with our team today.

.png)